Table of Contents

A fundamental challenge CPGs (consumer packaged goods corporations) contend with is how to best identify relevant target businesses in their TAM (total addressable market)?

Is it by extracting a list of target businesses from the in-house CRM system, buying a prospecting list, using lists from external data providers generated based on several parameters relevant to the kind of businesses you sell to?

If any or all of these is the method your field sales teams use, most likely you’re still unaware of as many as 15% of the businesses in your TAM that are relevant for your product categories. That figure is based on data from our work with CPGs using the Explorium External Data Platform.

What’s wrong with the data you use? It’s insufficient. You don’t have all the data you need to correctly pinpoint all the businesses in your TAM that would most likely be interested in your products. It’s like deciding to buy a home based on its location, square footage, and price – all essential pieces of information and a great starting point, but not enough to decide if you want to live there.

Our platform solves the TAM relevance problem by providing you with access to more and more informative data points for example, employee YoY growth, departmental growth, technographics, website visitors, social media profiles, customers reviews, number of locations, and (thousands!) more. The platform also gives you the tools to add the new data signals and build ML-based models that identify the businesses you should target. We invite you to read our white paper, How You Can Use ML Today to Optimize Your Field Sales, for the details. In the meantime, here is background on why the problem exists.

For CPGs, many, if not most, of your customers are small and medium-sized businesses. Not a lot of information is available about them, and they are not legally required to make information available. This makes data hard to find, and the dearth of information causes mistakes, especially about a critical piece of data – the type of business the potential target is engaged in. Sometimes, the type of business ends up not being classified at all. Obviously, it’s a challenge to determine whether a business would make a good potential customer if you don’t have all the facts.

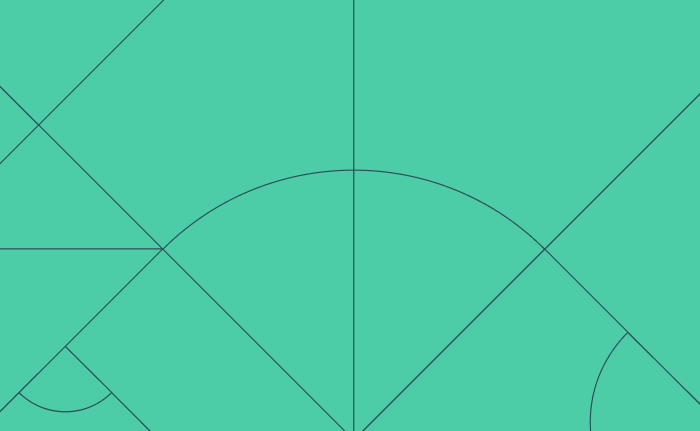

The figure below illustrates the kinds of results insufficient data leads to. Note there are two squares outlined in yellow. If your focus is too wide (outer, large square), some of the businesses that are included in it (in gray) have low or no relevance and your salespeople pointlessly pursue them. If the focus is narrow and only on the inner square – you end up missing out on some businesses that could be excellent targets (in green) but do not necessarily align with the dimensions used in the mapping. Incorrect classification results include irrelevant businesses or omit relevant ones, both of which end up costing you, in different ways.

You want your TAM to include all the relevant businesses and only the relevant businesses. That’s what the solution you use to identify businesses in your TAM should provide.

Sound like what your organization needs? Sign up for a free trial and start expanding your customer base.